Australia Recipient Created Tax Invoice

Australian Brand Ambassadors, who earn $75,000 AUD or more within the Australian financial year are required to have an Australian Business Number (‘ABN’) and be registered for GST. (Goods & Services Tax)

Brand Ambassadors who earn less than $75,000 AUD within the Australian financial year can also apply for ABN and register for GST.

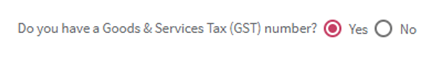

Those who are registered for GST must advise Plexus of this in order to have the GST amount added to their commission payments and to obtain a RCTI. You can do so by following the below steps.

- Go to My Account in the Virtual Office

- Input ABN

- If you are registered for GST click ‘Yes’

After this is completed all commissions thereafter (including incentives/promos) will be paid with an additional 10% added. Brand Ambassadors will be responsible for remitting the 10% GST to the Australian Taxation Office (ATO) .

For documentation requirements you can obtain Recipient Created Tax Invoice (‘RCTI’) at the below location:

In the virtual office under “My Business” there will be a section called Tax Invoice. Here you will find every tax invoice.

| Earnings Statement | At the end of each fiscal year, you will be provided an earnings statement located in the same location described above dated 6.30. |

| The no-ABN withholding rule | If an Australian Brand Ambassador earns over $15,000 AUD within the Australian financial year and does not have a valid ABN on their Plexus account, they are subject to a tax withholding of 47% of each commission payment exceeding $15,000 AUD (including incentives/promos). |

| If I add a valid ABN, will you release the withholding amount? | No, Plexus will report and remit the amount withheld to the Australian Taxation Office. At the end of the financial year Plexus will send the Brand Ambassador a “statement of earnings" detailing all earnings, taxes withheld and GST paid. |

| DSA Resources | For more information on Tax Considerations, Brand Ambassadors should visit the Tax Centre on the Direct Selling Australia's website. |